August News To Know

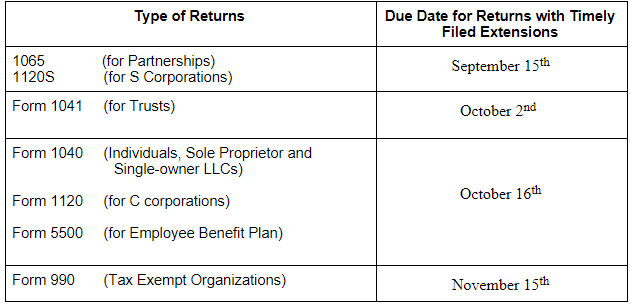

It’s hard to believe that summer is almost over. With September around the corner, we are hard at work finalizing extended tax returns. If you filed an extension last spring, please reach out to your CJBS team member with any questions about your return or extension. For your convenience, all the extension deadlines are listed in a chart below.

With the end of the year coming soon, now is the time to focus on optimizing your Tax Planning Strategies. Specifically, we have highlighted three important areas for you to consider. As always, if you have any questions about your specific situation, please reach out to your CJBS team member.

- Pass Through Entity (PTE) tax: We work with our clients every quarter to ensure that their PTE is up to date and on track to be paid on time. Businesses can adjust their tax obligation (and increase their deduction) by electing to pay the PTE. This legislation allows for the company to pay the partner’s or shareholder’s income tax obligation and bypass the otherwise applicable federal cap limitation. It’s important to assess your quarterly obligation to avoid the Failure to Pay Penalty.

- Cryptocurrency: We continue to encourage you to maintain records that document receipt, purchase date, cost basis, fair value at the time of sale, exchange, or other acquisitions (i.e., via an airdrop) or dispositions of your virtual currency. Please contact our office for additional guidance on when and how to report and treat virtual currency and cryptocurrency transactions.

- Bonus Depreciation and Assets: For 2023, bonus depreciation falls to 80%, from 100% in 2022. However, expensing assets has increased to $1.16 million. You can still take advantage of this strategy for year-end tax planning to determine the tax and cost savings benefits of accelerating your purchases or depreciation expenses.

As ever, if you have any questions about how you can optimize your financial situation, please contact us. We are here to help.

Stay safe & healthy,

The CJBS Team