February News To Know

Dear Clients and Friends,

Tax season is here, and the CJBS team is fully geared up to prepare your 2024 tax returns. We’re committed to supporting you through this busy period and aim to make your experience as efficient and seamless as possible.

Here’s how you can help us help you:

- Document Submission: Start sending us your tax documents now. The earlier we receive your information, the quicker we can begin processing your return.

- Business Clients: Ensure your year-end accounting is complete. For partnerships and S-corporations, remember the IRS deadline on March 17 requires timely submission.

- Individual Clients: Aim to submit all documents by March 24 to ensure we meet the IRS’s April 15 filing deadline and avoid any last-minute rushes.

Submission Options:

You can submit your documents through our Client Collaboration HUB, Secure Portal, or by traditional mail/drop-off.

We are here to assist you every step of the way and ensure your tax season goes smoothly. Thank you for your trust and partnership—we look forward to another successful tax season together.

To facilitate a smooth and precise tax filing, it’s important to compile and submit all necessary documents early. Incomplete or missing information can lead to delays in processing your tax return, so please ensure you’ve included everything. Here’s a list of common documents required for individual tax preparation:

- W-2 Forms: From all your employers over the past year.

- 1099 Forms: For other income such as freelance work (1099-NEC), interest (1099-INT), dividends (1099-DIV), or stock sales (1099-B).

- K-1 Forms: Income from partnerships, S-corporations, estates, or trusts.

- Property Tax Records: Documentation of property taxes paid during the year.

- Mortgage Interest Statements (Form 1098): Home mortgage interest paid.

- Charitable Contribution Receipts: For donations to qualified organizations.

- Medical Expense Documentation: Significant out-of-pocket medical expenses that may qualify as deductions.

- Educational Expense Forms (Form 1098-T): For tuition or related educational payments.

- Retirement Contributions (Form 5498): Records of contributions to IRAs or other retirement plans.

- Childcare Expense Receipts: For dependent care credits, if applicable.

- Health Insurance Forms (Form 1095-A/B/C): Proof of health coverage.

Ensuring your documentation is complete and accurate helps us prepare your return efficiently and maximize any potential deductions or credits. If you’re unsure about any documents, please reach out—we’re here to assist you

For Individual Clients: Important Reminders

Please keep the following items in mind once you receive your completed return from CJBS:

Govt File – This file contains your signature pages and payment vouchers (if applicable)

- You MUST return the completed signature pages in order for your return to be filed

- You MUST access the Govt file to retrieve your payment vouchers

Data Security During Tax Season

As you prepare and share your tax documents, maintaining vigilance against fraud and scams is crucial. Here are essential tips to keep your information secure:

- IRS Communication: The IRS will never initiate contact via email. All official communications will come through traditional mail.

- Verify Sender Information: Before opening any attachments or clicking on links, ensure the email addresses are legitimate and from trusted sources.

- Guard Personal Information: Be cautious with any requests for personal information for “verification” purposes, especially from unsolicited messages or forms.

- Scrutinize Official Correspondence: Be wary of letters purporting to be from the IRS or other governmental bodies that appear suspicious. Look for telltale signs of fraud such as misspellings, poor grammar, or odd formatting.

- Enable Multifactor Authentication: Whenever possible, activate multifactor authentication on your email and other sensitive accounts to add an extra layer of security.

At CJBS, we prioritize your data security by providing secure methods for sending and receiving documents, including our Client Collaboration HUB, Client Portal, and ShareSafe. We are committed to protecting your privacy and ensuring your peace of mind.

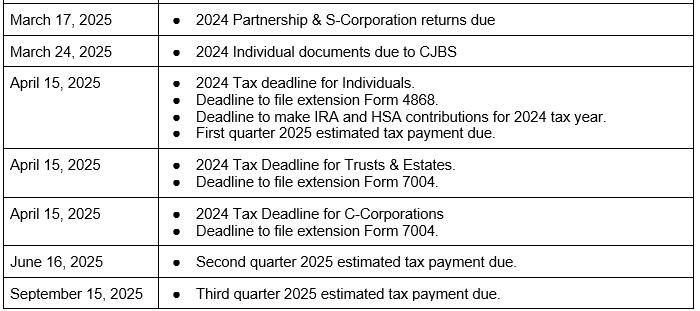

Upcoming Tax Deadlines

Below are due dates to keep in mind for the first half of 2025:

Northshore Professional Group Client Open House

At the end of January, we were delighted to host an open house at our office to warmly welcome the clients of the Northshore Professional Group. It was a wonderful opportunity for clients to meet our team, explore the new home for the Northshore group, and get to know the expanded CJBS family. Guests enjoyed an evening of great conversation, delicious food, and drinks in a relaxed and welcoming atmosphere. We are thrilled to have shared this special moment with our clients and look forward to continuing to serve them in the years ahead.

2025 Tax Season Kick Off

Our annual Tax Season Kick-Off Meeting was a fantastic way to launch what we like to call “Opportunity Season!” This year, we celebrated in style with a jersey themed event, bringing team spirit front and center as we gear up for a busy and rewarding tax season. Our tradition of making tax season fun continues with weekly theme days to keep the energy high and the teamwork strong. Check out some of the highlights from our kickoff celebration in the photos below! Let’s tackle this season together like the champions we are!