January News To Know

Dear Clients & Friends,

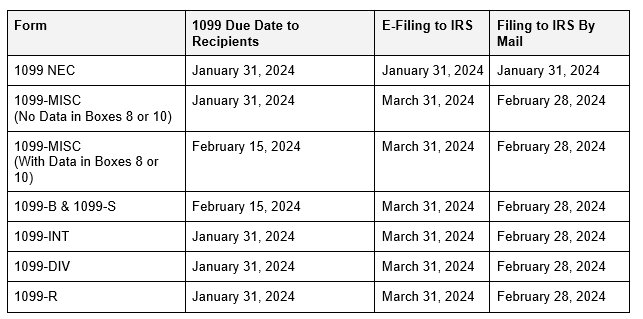

Happy 2024! The new year has begun, which means it’s time to start finalizing your 2023 taxes if you haven’t already. Individuals will start receiving tax documents like W2s & 1099s in the coming weeks. If you are a business owner, the most pressing issue is ensuring that you meet the dates for 1099 filing, in order to avoid any penalties. For your convenience, here is a simple table below outlining the respective 1099 deadlines:

A new year can also mean new opportunities. That is true for one of our own, Gabriela Ursu, who has become an income member here at CJBS. Gabriela has been with the firm for over 10 years and has been an asset during her time here. Congratulations Gabriela!

2023 didn’t see nearly as many tax law changes, compared to 2022. There are several new tax credits to take advantage of for individuals and businesses. Energy credits, retirement plan credits, and employee retention credits are a few changes to consider for your 2023 taxes:

- IRS PIN— You will ONLY receive a PIN if you applied for one in a prior year. Typically, the IRS mails these PINs in December for the upcoming year as an additional security measure to protect your tax-related data from potential identity theft and fraud. If you signed up for a PIN one year, you will get a NEW PIN every year.

- Energy Credits for Individuals— The IRS introduced several energy credits for the purchase of clean vehicles and clean energy purchases for your home. The credit for purchasing a new clean vehicle is $7,500 and the credit for a used clean vehicle is $4,000. Along with that, 30% of qualified expenses for home improvements like solar panels, wind turbines, energy efficient windows and more are eligible to receive credits.

- Energy Credits for Businesses— Businesses can take advantage of the clean energy credit for the purchase of a clean vehicle for business use. That credit is also $7,500.

- Employee Retention Credit Claim— These claims require detailed filings and are still being processed by the IRS. Reach out to your CJBS trusted advisor for eligibility requirements in order to file a claim properly.

- Retirement Plans for Small Business— If your business established a retirement plan in 2023 and has 50 employees or less, 100% of the start-up costs can be applied towards a tax credit. For Illinois businesses, any business with 5 or more employees that has been operating for 2 years or more, needs to establish a retirement plan if they do not have one already. Businesses in Illinois need to begin offering a qualified plan or enroll employees into Illinois Secure Choice. Businesses that do not comply could be subject to fines and penalties.

- Did You Know?—You can create an online IRS account to manage your taxes and tax-related issues with the IRS. Visit IRS.gov/account for more information

Last month’s newsletter mentioned the Beneficial Ownership Information Reporting (BOI). In the coming weeks, look for guidance on the rules and requirements for this type of reporting from the CJBS team. For entities established in 2024, this report needs to complete within 30 days of incorporating. As always, we will be here to guide you through this new process.

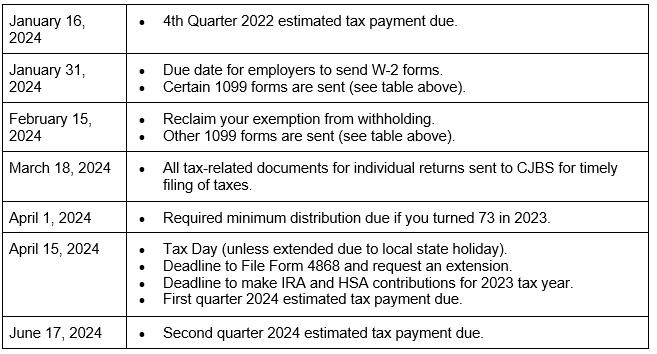

Finally, as we gear up for another tax year, we have highlighted important dates for you to remember.

We know this can be a stressful time for some of our clients and we are here to help. Of course, it’s better to connect with your CJBS team member sooner rather than later, especially if you have any questions or concerns.

Stay safe & healthy,

The CJBS Team