June News To Know

Dear Clients & Friends,

This month we are highlighting an area that directly impacts many of us – the recent tax proposals put forth by President Biden. As these proposals navigate through the legislative process, their potential to shape the economic landscape is significant. However, nothing has been signed into law as of now. Whether you’re an individual planning for the future, or a business strategizing for growth, be sure to check out our takeaways on these proposals.

Potential Tax Law Changes

President Biden has proposed several tax law changes in recent months:

- Raising the corporate tax rate to increase federal revenue.

- Adjusting tax rates for high-income individuals to promote tax equity.

- Closing tax loopholes to combat tax avoidance.

A significant aspect of President Biden’s tax proposals centers on adjustments to capital gains taxes, specifically targeting higher earners. The intention is to diminish the preferential treatment that capital gains have traditionally enjoyed compared to ordinary income. This move aims to:

- Align the tax rates of capital gains with those of ordinary income for individuals earning above a certain threshold, effectively reducing the gap between investment income and labor income taxation.

- Potentially introduce a new framework for taxing unrealized capital gains upon the transfer of assets for wealthy individuals, marking a profound shift in capital gains taxation.

Our Takeaways

While these tax proposals signal potential changes on the horizon, it’s important to remember they are not yet finalized. We advise against making any immediate alterations to your financial or business strategies based solely on these proposals. Our team is closely monitoring these developments and is fully prepared to guide you through the actual changes if or once they do become law. Our priority is ensuring you’re well-positioned to navigate these shifts effectively, with strategies tailored to your unique situation.

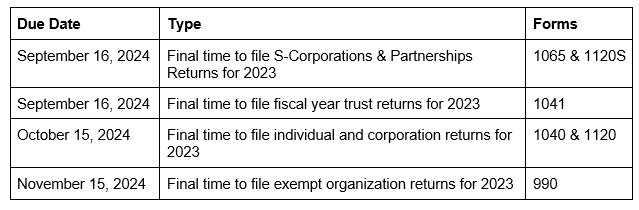

2024 Due Dates

In addition, we are also outlining the remaining due dates for 2024 if your return is on extension. For our clients who have 2nd Quarter Estimate Payments, remember they are due on June 17th, 2024.

Lastly, for our Northbrook locals, check out the Block Party @ St. Norbert’s this Saturday, June 8th! CJBS is sponsoring the music stage for the 3rd year in a row. Stop by the block party for some awesome live music, rides, games, food and drink!

Stay safe & healthy,

The CJBS Team