March News To Know

Dear Clients & Friends,

Thank you to everyone who promptly submitted their information for the March 17th corporate tax deadline—we appreciate your help in getting all S-Corporation and Partnership returns either filed or extended on time.

With that milestone behind us, our focus now turns to the Individual Tax Deadline on April 15th. Please remember:

- Filing Deadline: Your individual tax return (or extension) is due by April 15th.

- Document Submission: To ensure we have enough time to prepare your return, all documents must be sent to CJBS by March 24th.

- Extensions: If your return isn’t ready by April 15th, we’ll automatically file an extension for you—no need to request one. However, keep in mind that extensions only give you more time to file, not to pay. If you owe taxes, the payment is still due by April 15th to avoid penalties and interest.

If you’re not sure whether you’ll owe, contact us so we can help estimate any payment.

For those receiving returns electronically, please review all files and check for any payment vouchers or additional documents that require your attention.

As always, we’re here to make tax season as smooth as possible. If you have any questions or need assistance, don’t hesitate to reach out—we’re here to help!

Making Your Tax Payments Online

Paying any taxes owed or estimated payments online through IRS Direct Pay is the most secure, fastest, and convenient way to submit your payments. Here’s what you need to know:

What is IRS Direct Pay?

- IRS Direct Pay allows you to quickly and securely pay your individual tax bill or make an estimated tax payment directly from your checking or savings account without needing to create an account.

Why Use IRS Direct Pay?

- Payments are processed instantly, giving you immediate confirmation.

- There are no fees for using this method.

- You’ll avoid the risks of mailing checks, such as delays or potential misplacement.

- It’s available 24/7, so you can make a payment anytime.

How to Access IRS Direct Pay:

- Visit the IRS Direct Pay website here: IRS Direct Pay

- Follow the prompts to verify your identity and make a payment.

- Be sure to select “Balance Due” or “Estimated Payment” as the reason for the payment.

For other payment options, such as paying by credit or debit card, visit the IRS page: Pay Your Taxes.

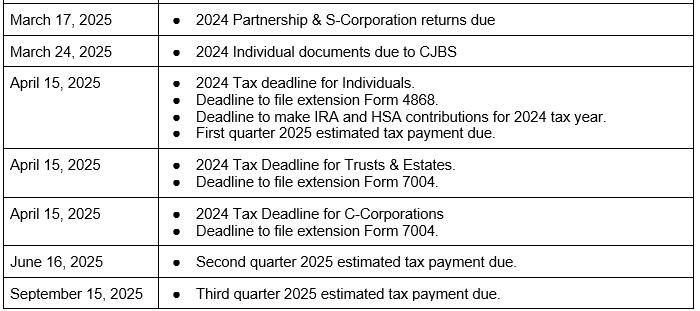

Upcoming Tax Deadlines

Below are due dates to keep in mind for the first half of 2025:

Tax Season Theme Days & Office Celebrations

Tax season might be one of our busiest times, but that doesn’t mean we can’t have some fun along the way! Around the office, we’ve been keeping things lively with our weekly spirit days—like jersey day, crazy hat day, alma mater day, and more. These light-hearted celebrations are a great way to keep our team energized and connected during such a hectic time.

We’ve also had the pleasure of celebrating some incredible milestone birthdays and work anniversaries with our team. These special moments remind us that while tax season is serious business, it’s our people who truly make it all worthwhile!