September News To Know

Dear Clients and Friends,

We hope you enjoyed a relaxing Labor Day weekend and made the most of the “official” end to summer. As kids head back to school, we’re gearing up for the September 16th extension tax deadline for Partnerships and S-Corporations. If your business return is currently on extension, please submit your final 2023 tax documents to us as soon as possible to ensure a timely filing.

With election season underway, you may hear candidates discussing tax-related topics, including the recent focus on unrealized capital gains. These gains reflect the increased value of assets that haven’t been sold. Some proposals suggest taxing them as a means to address wealth inequality, which could have significant impacts on investment strategies and financial planning. It’s important to stay informed about these potential changes and their implications.

Don’t miss the latest article on our News & Insights page, where we share insights for manufacturers still navigating post-covid supply chain challenges. We work closely with you to provide the strategies and analysis necessary for making informed financial decisions and significant purchases.

We’re also excited to share some great news—please join us in celebrating the promotions of Jack Hanson, Dasha Gemberg, and Mitch Johnson, who were all recognized for their hard work and dedication this summer. On our audit team, both Jack Hanson & Dasha Gemberg were promoted to Senior Associates. On the tax side, Mitch Johnson was promoted to Supervisor.

Unrealized Capital Gains: What Could the Impact Be?

You may have recently heard discussions about the potential taxation of unrealized capital gains. Essentially, unrealized capital gains are the increases in the value of assets that an investor holds but hasn’t sold. Since the asset hasn’t been sold, these gains remain “unrealized,” meaning no taxable event has occurred under the current tax system, which only taxes gains once they are realized through the sale of assets.

The idea behind taxing unrealized gains is to ensure that wealthy individuals pay taxes on income that hasn’t been realized through sales. Implementing such a tax would require significant changes to the tax code and IRS processes, leading to additional compliance costs for both the IRS and taxpayers, who would need to track, report, and audit these gains.

At this stage, the feasibility of this proposal is under discussion, but no laws have been enacted. We will keep you informed on this topic as new developments arise.

Upcoming Tax Deadlines

2023 Partnership & S-Corporation returns that are currently on extension are due for filing on Monday September 16th. Reach out to your CJBS advisor immediately if you have not submitted your business documents to us.

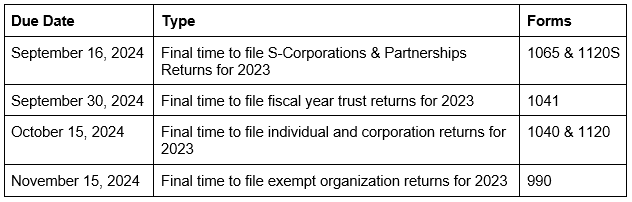

For our individual clients who are on extension, please keep the October 15th deadline in mind. You can easily submit your documents through our Client Collaboration HUB, access our Client Portal, or use our paper organizer to get started on your individual 2023 tax filings. We’ve also outlined the remaining deadlines in 2024 for your reference:

Please don’t wait—meeting these deadlines is crucial to manage your tax obligations effectively.!

Stay safe & healthy,

The CJBS Team