May News To Know

While the tax deadlines for individuals and corporations are behind us, the 2022 Tax Deadline for Nonprofit Organizations is Monday, May 16. If you are a nonprofit, here is some valuable information that can help you plan:

- On April 26, 2022, the IRS published a helpful new guide to filing Nonprofit taxes. It includes an explanation of the different forms (such as Form 990-series, etc.) and a reminder that e-filing is now mandatory for nonprofits. You can access the IRS’ guide here.

- While the IRS exempts many nonprofits (charities, foundations, and religious organizations, etc.) from paying federal income taxes, nonprofits must file annual returns.

- If a nonprofit fails to file for three years in a row, its tax-exempt status will be automatically revoked. Additionally, the IRS has no appeal process for automatic revocations, which would put the organization at risk to both lose its nonprofit status and pay income taxes.

- Teacher Appreciation Week is this week. This is a reminder that, if you are an educator you can deduct up to $250 in expenses for books, software, and other classroom materials. To learn more, click here.

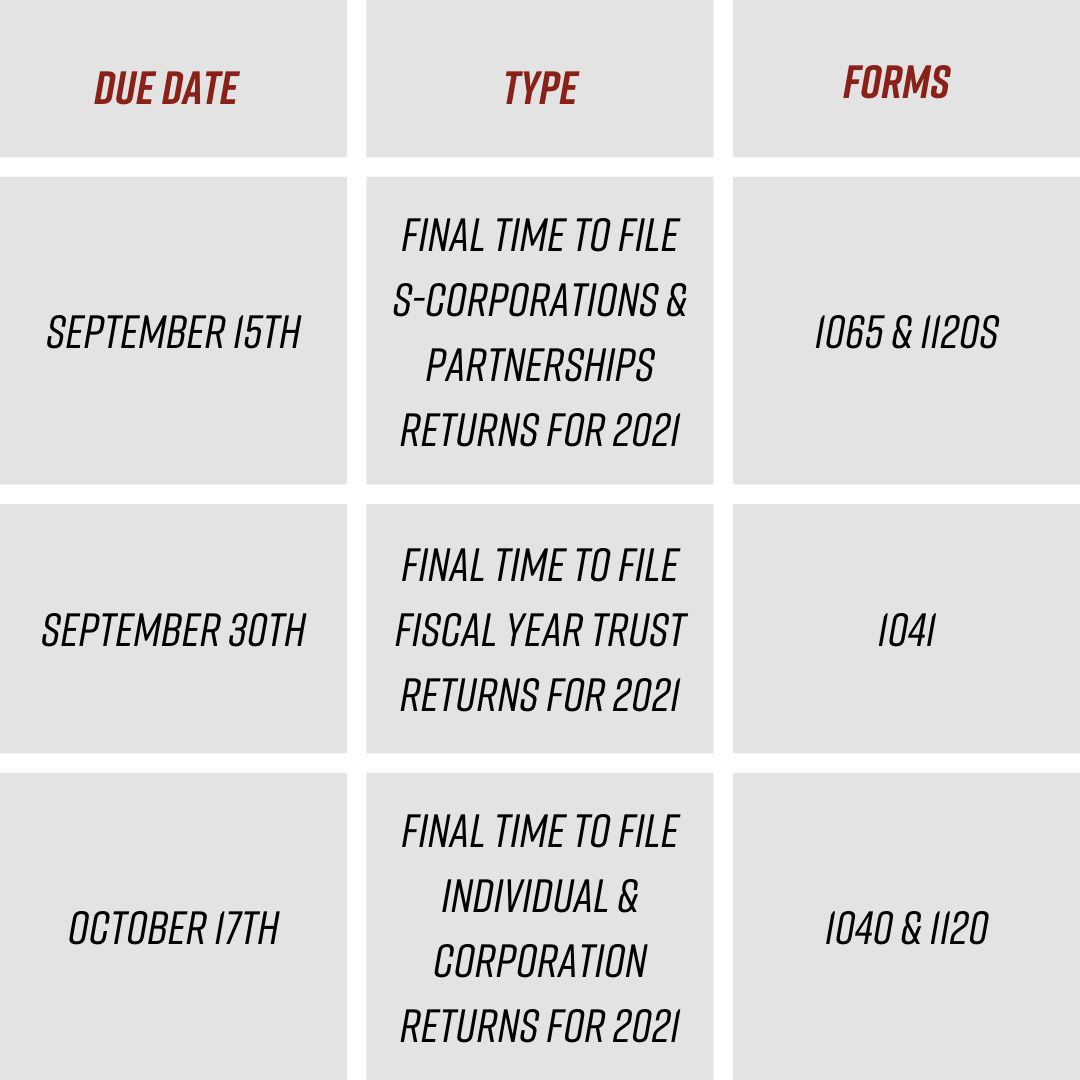

Filed an Extension? If you recently filed an “extension to file” for your taxes, here are some dates you may want to put on your calendar for 2022:

As always, the CJBS Team is here to help. If you have any questions about your taxes or financial situation, please reach out to us at your convenience.

Stay safe & healthy,

The CJBS Team

More News & Insights

New Jersey entered adult-use cannabis sales later than many early-adopter states, but by 2026 the market has firmly established itself as one of the most closely watched cannabis economies in the Northeast. Strong demand, high prices, and ongoing regulatory evolution are shaping how the industry grows and where pressure points are emerging. As operators, investors, […]

Minnesota’s adult-use cannabis market may still be in its earliest chapter, but by 2026 its direction is starting to emerge. The launch of legal sales in late 2025 brought early revenue momentum, while also exposing structural frictions around licensing, logistics, and how the market has been built to scale. Unlike many states that leaned heavily […]

By 2026, New York cannabis has moved past the initial launch phase and firmly established itself as a major U.S. market. With licensing issues largely resolved and retail availability expanded, capital has already flooded the state. Consequently, success for operators is no longer about simply gaining market access, but about the efficiency and structural integrity […]

Senior living M&A activity continues to attract investors, operators, and strategic buyers looking to grow portfolios or reposition assets. But while deals can move quickly, one of the most common—and costly—mistakes is waiting too long to involve a CPA. At CJBS, we consistently see stronger outcomes when a CPA is brought into a senior living […]

The passage of the One Big Beautiful Bill introduces meaningful changes to the federal tax landscape—and one of the most impactful updates for individual taxpayers is the adjustment to the State and Local Tax (SALT) deduction cap. While many people are hearing about these changes during the 2026 tax filing season, it’s important to clarify […]

Ohio’s cannabis market has moved quickly since adult-use sales launched in August 2024. What began as a tightly controlled rollout is now a billion-dollar market grappling with the realities of price compression, regulatory tightening, and uneven local access. As we head into 2026, operators and investors are no longer asking whether demand exists—it clearly does. […]