July News To Know

Dear Clients & Friends,

We hope your 4th of July weekend was filled with joy and celebration! As we continue to enjoy the summer, we want to keep you updated with the latest and most pertinent information.

For those using QuickBooks Online through CJBS, please note the upcoming annual price adjustment detailed in our News to Know section. Our aim is to maintain cost-effectiveness while keeping you fully informed.

In cannabis news, there’s a potential reclassification of cannabis from a Schedule I to a Schedule III controlled substance, although it hasn’t yet become law. Dive into our Cannabis section for further details on what this could mean for the industry.

Should you have any questions or need further assistance, please don’t hesitate to contact your CJBS advisor as we move into the third quarter.

QuickBooks Online Subscription Cost Increase

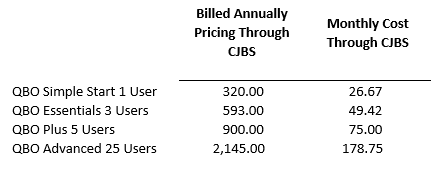

Every summer Intuit raises the annual rate of their QuickBooks Online Subscriptions. At CJBS we bill our clients who utilize QBO on an annual basis. This allows you to take advantage of our wholesale discount. Please note that this increase does not pertain to additional QuickBooks products like payroll, bill pay, etc. Please see below the newest rates for the different QBO products:

Cannabis News

The cannabis industry is on the verge of significant changes with the potential rescheduling of cannabis at the federal level. This could bring about a myriad of federal tax implications that you need to be aware of. However, it’s important to note that as of now, nothing has been signed into law.

For our cannabis clients who are operating plant-touching businesses, this means that you should continue to comply with the current tax regulations, specifically the 280E taxes. The IRS Section 280E disallows deductions and credits for amounts incurred in the business of trafficking certain controlled substances, including cannabis. This shift would be a tremendous win for the industry, but until it becomes law and the IRS issues new guidance, we do not recommend making any changes to your business. Our Cannabis CPA’s who Care are here to talk you through any questions you have!

Reach out to your CJBS advisor for any questions you may have as we look ahead to 3rd quarter.

Stay safe & healthy,

The CJBS Team