May News To Know

Dear Clients & Friends,

Hello! Spring is here, and tax season is now officially behind us. Here at CJBS we take advantage of the beautiful Chicago weather and a chance to rejuvenate and spend time with our loved ones by closing our office at 2 pm on Fridays from May – August.

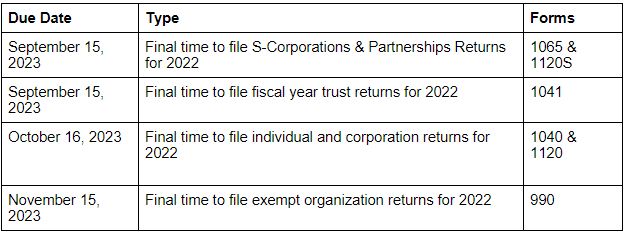

Unless you filed an extension, the deadlines for filing 2022 tax returns for individuals and corporations are now behind us. If you filed for an extension, we have outlined the remaining deadlines for 2023:

At CJBS, we work hard year-round to provide the best service to our clients. Additionally, we pride ourselves on creating a work environment that fosters growth and collaboration. As such, we were thrilled to learn (and announce!) that we have been nominated for three awards by our clients and employees:

- Best Company in Illinois (nominated by clients)

- Best Company to Work for in Illinois (nominated by employees)

- Best Company to work for Women in Illinois (nominated by employees)

We would like to extend our sincerest gratitude to our clients and employees who responded to the surveys and nominated us for these awards. It goes without saying that it means a lot to receive both of these nominations, and we look forward to continuing our level of service and support for many years to come. This is very exciting and none of this would be possible without the your trust and loyalty Stay tuned for an upcoming press release with more information.

While the IRS exempts many nonprofits (charities, foundations, and religious organizations, etc.) from paying federal income taxes, they still need to file annual returns. If a nonprofit fails to file for three years in a row, its tax-exempt status will be automatically revoked, and the IRS has no appeal process for automatic revocations. Not filing in a timely manner would put an organization at risk of losing its nonprofit status. It’s important to stay on top of IRS updates for nonprofit organizations, which you can find here or ask your CJBS team member.

Stay Safe & Healthy,

The CJBS Team