News Flash: American Rescue Plan Act Signed Into Law

Dear Clients & Friends,

The President yesterday signed the American Rescue Plan Act into law, so the much anticipated $1.9 Trillion Covid-19 stimulus package is official. The bill includes:

- An extra $50 billion for the second round of the Paycheck Protection Program (PPP2); the deadline for applications remains March 31, 2021, but is likely to be extended.

- Extending the Employee Retention Credit (ERC) until year-end

- Start-up businesses that began after February 15, 2020, and had gross receipts of less than $1 million are eligible.

- 2020 tax-free unemployment benefits

- Modification of the premium tax credit (PTC)

- Fully refundable Child Tax Credit

- $300 weekly unemployment benefits until September 6, 2021

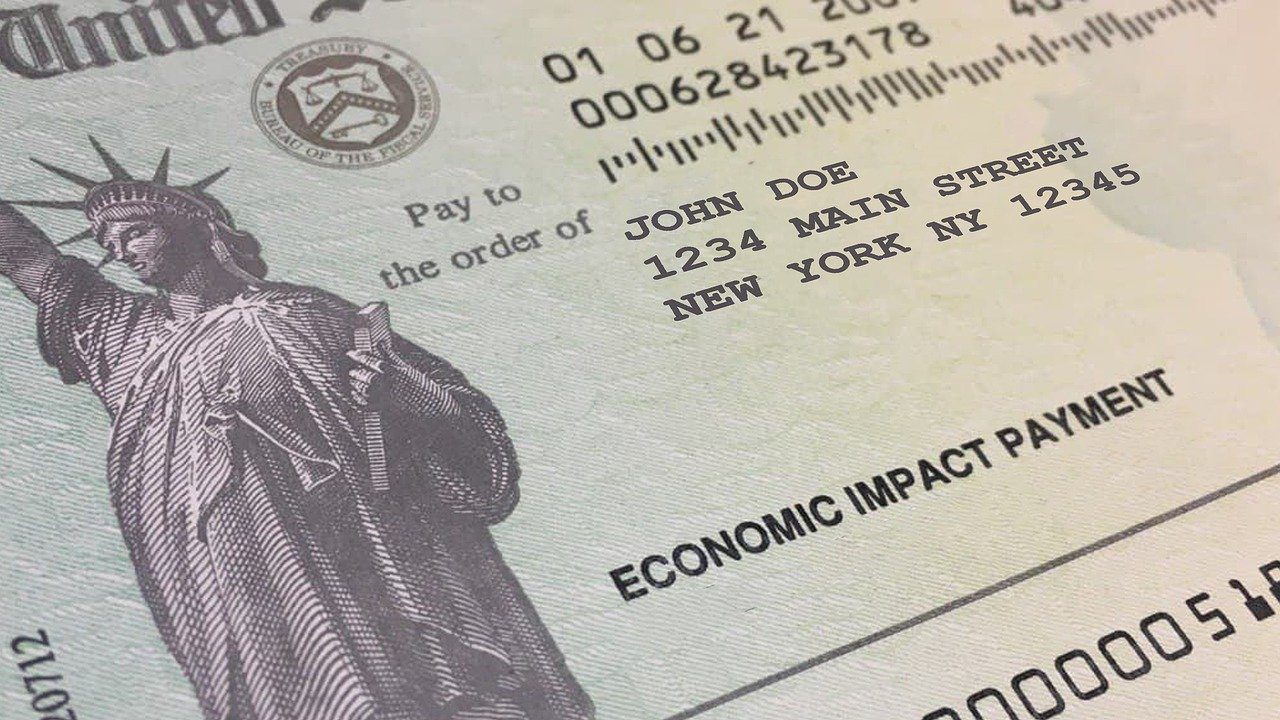

- $1,400 Economic Impact Payments (EIP) for all qualified individuals and children and adult dependents

Haven’t filed your 2020 taxes yet?

We advise that if your adjusted gross income is greater in 2020 than in 2019, hold off on finalizing your 2020 until the filing deadline so that the higher income will not reduce your EIP payment.

Already filed your 2020 tax return with unemployment benefits taxed and/or PTC repaid?

We advise you hold off on amending your 2020 tax return. Our contacts at the IRS stated they are unsure if they will automatically issue refunds for returns already filed or if an amended tax return is needed. More guidance to come soon. Stay tuned!

Many other provisions in the bill can impact your 2020 and 2021 personal and business tax returns.

Click here for a detailed summary. If you have any questions on how these provisions will impact you, please contact us.

Stay safe & healthy,

The CJBS Team