September News To Know

Dear Clients & Friends,

September is here—and so is extension season. If your return is on extension, please send any outstanding documents now to keep filing smooth and on time.

How to Send Documents (Securely)

Upload via the Client Collaboration HUB, Client Portal, or ShareSafe. Our team can help if you need access or a quick walkthrough.

Upcoming Extension Deadlines

- Sept 15 – 2024 Partnership & S-Corporation (Forms 1065 & 1120S)

- Sept 30 – 2024 Trusts (Form 1041)

- Oct 15 – 2024 Individuals & C-Corporations (Forms 1040 & 1120)

Tax Law Update: “Big, Beautiful Bill”

Major changes begin in 2025. Highlights include:

- Lower individual rates and a higher standard deduction

- Updated itemized-deduction rules

- Expanded child tax credit and other family benefits

- Business changes affecting deductions/credits and phaseouts

For details and planning ideas, read our full article.

If you have questions, need help gathering documents, or want to discuss how the new law may affect you, your CJBS advisor is ready to help.

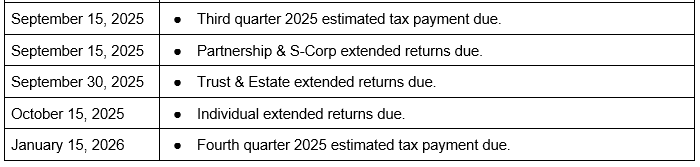

Upcoming Tax Deadlines

If your business or personal return is on extension, we’re aiming to finish well before the September 15 (business) and October 15 (individual) deadlines. Please upload any remaining documents to the Client Collaboration HUB or Client Portal now. The sooner we have complete information, the smoother and more accurate your filing will be. Need help? Your CJBS advisor is ready to assist.

Charitable Giving & Community Engagement

As fall approaches, we’re inspired by the many ways our CJBS partners and team members give back to the community. From supporting mental health initiatives, educational programs, and youth organizations to volunteering with groups focused on food security and animal welfare, our leadership is committed to making a positive impact in a variety of ways.

We hope their stories spark your own spirit of giving this season. If you’re planning to support a cause close to your heart, our team can help you make the most of your charitable contributions—whether through donor-advised funds, tax-smart gifting strategies, or community engagement.

Let us know how we can support your philanthropic goals this fall!

Warm regards,

The CJBS Team